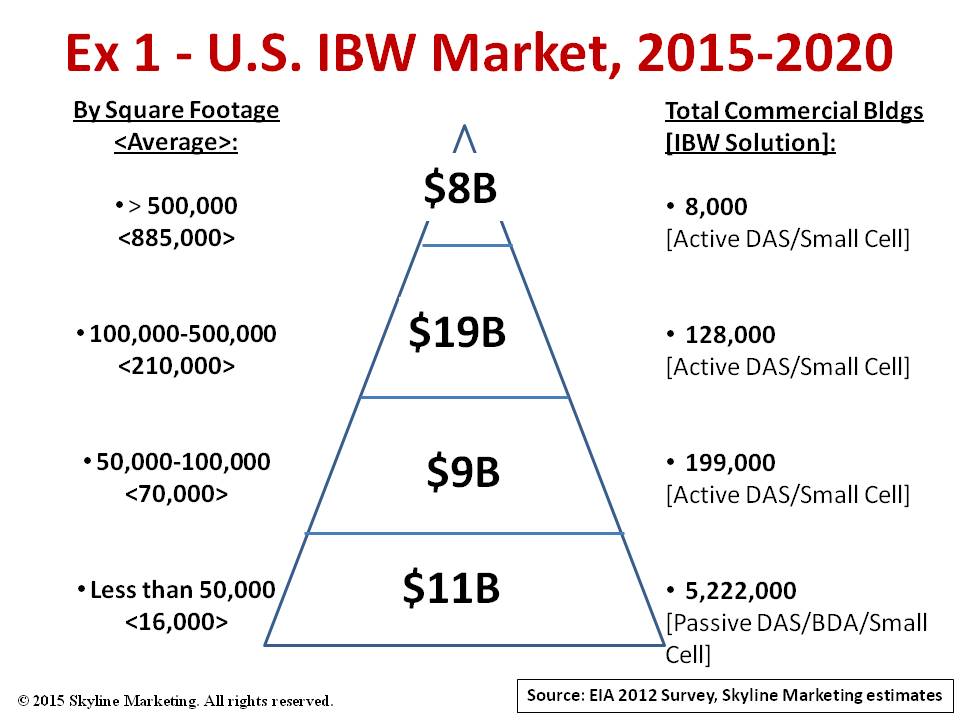

The U.S. in-building wireless (IBW) equipment market will tally more than $47 billion through 2020.

Big bucks are attractive but getting to them will be a challenge for suppliers, carriers and end users alike. Every building is different. No one technology solution fits all. Carriers need to be on board in every case. And financing these deployments can be daunting.

The market drivers are evident, nonetheless.

Major equipment vendors such as Cisco and Ericsson forecast 10-fold mobile data growth and volumes into the extabyte per month range within the next five years. More important, studies by major wireless service providers such as AT&T Mobility show that 70-80 percent of all wireless calls originate or terminate inside buildings. On top of all that, we get mind-boggling forecasts of the Internet of Things (IoT) sensor points in the “billions and billions” (to quote the late Carl Sagan) range. Together, these data imply a significant demand for IBW systems in the next several years.

How does that demand shape up?

Reliable, publicly-available data from the Energy Information Administration (EIA), a branch of the U.S. Department of Energy, is a good start point. EIA’s Commercial Buildings Energy Consumption Survey (CBECS) survey determines energy consumption of commercial buildings by size of building in square footage, the number of buildings in that size range, and how these buildings are used. EIA’s 2012 CBECS survey data (updated April 2015) shows that there was a total of 5.6 million U.S. commercial buildings that housed 87 billion square feet of commercial space for all types of usage.

This data serves as a useful base for projecting the IBW market. We organized and summarized this data in Exhibit 1.

Our market estimates assume IBW penetration in a proportion of the number of buildings, the average size of buildings in square feet, and cost per square foot to install and activate the system. There are a lot of variables to consider, however. No one building is the same. So we’ve stayed fairly conservative with our estimates and assumptions.

Tiered Approach

Tier 1 comprises the largest public venues of 500,000 square feet or more. Such venues include stadiums, airports, arenas, malls, very large office buildings and factories that have a high concentration of people for most of the day. There are 8,000 of these. IBW systems that serve such facilities are either Active DAS or small cells, depending on the size and layout of the facility. Up to now, wireless carriers themselves have funded IBW systems in these facilities generally with one of the major wireless carriers taking the point on the initial installation. Other carriers are added once the system is in service. We think this is an $8 billion market.

Tier 2 represents the next wave of IBW deployments. Buildings in the 100,000-500,000 square foot range represent the sweet spot for IBW systems. First, there are a lot of them, 128,000 according to the EIA survey. Secondly, vertical applications – corporate enterprise, hospitality, education, healthcare, shopping malls, industrial sites, either as standalone buildings or multi-building campuses – will benefit the most. To a large extent, carriers are expecting somebody else to fund these projects. Consequently, Active DAS or small cell IBW deployments in these applications are funded either by property owners or neutral-host operators such as tower companies or systems integrators. This segment is estimated at a lofty $19 billion.

Tier 3 includes 199,000 buildings in the 50,000-100,000 square foot range. One could argue that this tier encompasses more of the small type of applications as in Tier 2, just in smaller buildings or campuses. Active DAS or small cells serve the IBW requirements. Funding, either by property owners or neutral-host operators, will be a key determinant as to how many of these buildings will be equipped for IBW. Nonetheless, we estimate this segment at $9 billion.

Tier 4 comprises all buildings less than 50,000 square feet. And there are millions, a total of 5.2 million. Note that over half of these building are less than 25,000 square feet. Small businesses, retail stores, professional firms, and small office/home office (SOHO) in this segment are best served by Passive DAS or BDAs and small cells including femtocells. Most of these applications likely will be user-funded and often will involve only one carrier. Still, we estimate that this low-end segment is worth roughly $11 billion.

If suitable funding mechanisms are available to end users, vendors and third-parties alike, then the market could be larger than what we’ve suggested here. At the same time, technology advances and competitive forces will tend to keep equipment prices and deployment costs in check.

IBW Solutions

We’ve referred to different, readily-available IBW technology solutions address the problem of how to get outside cellular signals inside of buildings in each market segment.

Active distributed antenna systems (DAS) deliver one or more wireless carrier signals from the DAS head-end equipment to indoor antennas throughout the building. Carrier radio frequency (RF) signals from a RF source at the head-end are converted into optical signals for transmission to DAS remote units that are located at strategic points, or on different floors, within the facility. DAS remotes convert optical signals back to RF for transmission over coaxial cable to a series of indoor antennas installed on each floor. These antennas deliver the cellular signals to users inside the building. The term ‘active’ means that the DAS electronic gear converts the RF signal to optical then back to RF. Active DAS can provide IBW services in very large facilities with multiple carriers sharing the system. New active ‘digital’ DAS systems utilize flexible Cat 5/6 Ethernet cables instead of fiber optic and coaxial cable between the head-end and the remotes. Alternate design schemes such as centralized DAS (C-DAS) or cloud radio access network (C-RAN) strive for lower deployment and operating costs.

Small cells, as the name implies, operate very much like large outdoor macrocells, but on a much smaller scale. Small cells generate their own RF signals, require their own electrical power source and must be connected to a ‘backhaul’ facility, that is, a high-speed connection to a central switching system for call routing. A small cell covers an area up to 20,000 square feet. Multiple small cells can cover buildings of various sizes. Typically, multiple small cells connect to a central service router in the building. IP and signaling traffic from all the small cells in the building then can be condensed on to a single backhaul connection from the building to the switching center.

Passive DAS systems derive an RF signal from a nearby macrocell using an outdoor ‘donor’ antenna. That RF signal is transmitted over coaxial cable to a bi-directional amplifier (BDA) or signal booster that simply amplifies the RF for transmission to one or more indoor antennas. The term ‘passive’ means that there is no conversion of the incoming RF signal, only amplification. Passive DAS or BDAs typically serve small areas of a few thousand square feet.

In the end, selection of the appropriate IBW system depends on the size of the facility, the number of users within the building and how those people use their wireless devices, and the overall costs to install and operate these systems.